The accounts payable (AP) process is a critical part of any business. It is responsible for ensuring that bills are paid on time and in full, and that all payments are properly documented. A well-functioning AP process can help to improve cash flow, reduce costs, and improve compliance.

However, the AP process can also be a time-consuming and error-prone process. Here are 15 ways to improve your AP process:

- Eliminate paper invoices. Paper invoices can be a major source of errors and delays. By going paperless, you can improve accuracy and speed up the AP process.

- Streamline and standardize your workflow. Having a clear and consistent workflow will help to ensure that invoices are processed quickly and accurately.

- Automate your AP process. There are a number of software solutions that can automate many of the tasks involved in the AP process. This can free up your AP staff to focus on more strategic tasks.

- Avoid AP fraud. AP fraud is a major risk for businesses of all sizes. By implementing strong controls, you can help to protect your business from fraud.

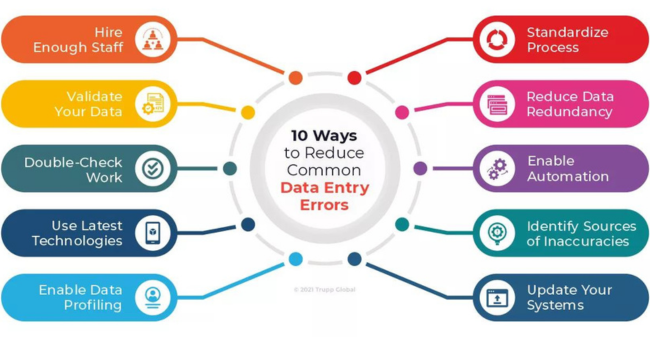

- Eliminate data entry errors. Data entry errors are a common source of errors in the AP process. By using automated tools, you can help to reduce or eliminate data entry errors.

- Avoid duplicate payments. Duplicate payments can be a costly mistake. By implementing controls to prevent duplicate payments, you can save money and improve your cash flow.

- Set up reminders for payments. It is easy to forget to pay a bill, especially if you are juggling a lot of invoices. By setting up reminders, you can help to ensure that all bills are paid on time.

- Reconcile your accounts regularly. Reconciling your accounts regularly will help to ensure that your books are accurate and that you are not overpaying any bills.

- Get approval for all payments. All payments should be approved by a designated person before they are paid. This will help to ensure that all payments are authorized and that there is no fraud.

- Track your spending. It is important to track your spending so that you can see where your money is going. This will help you to identify areas where you can save money.

- Negotiate payment terms with your vendors. You may be able to negotiate better payment terms with your vendors. This can help to improve your cash flow.

- Train your AP staff. Your AP staff should be trained on the proper procedures for processing invoices. This will help to ensure that all invoices are processed correctly and that there are no errors.

- Use technology to your advantage. There are a number of technology solutions that can help to improve your AP process. By using these solutions, you can save time and money.

- Be proactive. Don’t wait for problems to arise. Be proactive in managing your AP process and you will be able to avoid many of the problems that can occur.

- Continuously improve. The AP process is constantly evolving. By continuously evaluating your process and looking for ways to improve, you can ensure that your AP process is always running at its best.

By following these tips, you can improve your AP process and save your business time, money, and headaches.

Get Your Business and Banking Fundamentals in Order

As a business owner, you know that there are a lot of things to keep track of. From inventory to payroll to marketing, there’s always something that needs your attention. But one of the most important things you can do for your business is to get your banking fundamentals in order.

A strong banking relationship can help you save time and money, and it can also give you peace of mind knowing that your financial needs are taken care of. Here are a few tips for getting your business and banking fundamentals in order:

- Choose the right bank. Not all banks are created equal. When choosing a bank for your business, you’ll want to consider factors such as location, fees, and services. Be sure to compare multiple banks before making a decision.

- Open a business checking account. A business checking account is essential for any business. It will allow you to deposit and withdraw money, write checks, and pay bills. Be sure to choose an account that has the features you need, such as online banking and mobile deposit.

- Set up a credit card for your business. A business credit card can help you build your business credit history and earn rewards. Be sure to use your credit card responsibly and pay your bill in full each month to avoid interest charges.

- Get a line of credit. A line of credit can be a lifesaver if you experience a sudden cash flow shortfall. Be sure to shop around for a line of credit that has a competitive interest rate and terms that work for your business.

- Get to know your banker. Your banker is a valuable resource for your business. Be sure to get to know your banker and build a relationship. This will make it easier to get the help you need when you need it.

By following these tips, you can get your business and banking fundamentals in order. This will help you save time and money, and it will give you peace of mind knowing that your financial needs are taken care of.

Here are some additional tips for getting your business and banking fundamentals in order:

- Create a budget and stick to it. This will help you track your spending and make sure you’re not overspending.

- Pay your bills on time. This will help you avoid late fees and damage your credit rating.

- Reconcile your bank statements regularly. This will help you catch any errors or fraud early on.

- Get professional help if you need it. There are many financial professionals who can help you with your business banking needs. Don’t be afraid to ask for help.

By following these tips, you can set your business up for financial success.

Adopt the right payment solutions

The right payment solutions can help your business save time, money, and headaches. There are a variety of payment solutions available, so it’s important to choose the ones that are right for your business.

Here are a few things to consider when choosing payment solutions:

- Your industry: Some payment solutions are better suited for certain industries than others. For example, if you sell products online, you’ll need a payment solution that accepts credit cards.

- Your customer base: You’ll also need to consider the needs of your customer base. For example, if you have a lot of international customers, you’ll need a payment solution that accepts payments in multiple currencies.

- Your budget: Payment solutions can range in price from free to hundreds of dollars per month. It’s important to choose a solution that fits your budget.

Once you’ve considered these factors, you can start to compare payment solutions. Here are a few of the most popular payment solutions:

- PayPal: PayPal is a popular payment solution that allows customers to pay with credit cards, debit cards, and PayPal balances.

- Stripe: Stripe is another popular payment solution that offers a variety of features, including fraud protection and recurring billing.

- Authorize.Net: Authorize.Net is a well-established payment solution that offers a variety of features and integrations.

No matter which payment solutions you choose, it’s important to test them thoroughly before you start using them with your customers. This will help you ensure that they work properly and that your customers have a positive experience.

Here are a few tips for testing payment solutions:

- Create a test account: Most payment solutions allow you to create a test account. This is a great way to test the features and functionality of the solution without using your real data.

- Make a test purchase: Once you’ve created a test account, make a test purchase. This will help you verify that the solution works properly and that your customers can use it to pay for your products or services.

- Get help from customer support: If you have any problems with a payment solution, don’t hesitate to contact customer support. Most payment solutions have excellent customer support that can help you troubleshoot any problems.

By following these tips, you can choose the right payment solutions for your business and ensure that your customers have a positive experience.

Avoid Duplicate Payments

Duplicate payments are a common problem for businesses of all sizes. They can be caused by a variety of factors, such as:

- Human error: This is the most common cause of duplicate payments. It can happen when an invoice is processed twice or when a payment is made to the wrong vendor.

- System errors: Sometimes, duplicate payments can be caused by system errors. This can happen if an invoice is not properly entered into the system or if the system does not properly track payments.

- Vendor error: In some cases, duplicate payments can be caused by vendor error. This can happen if a vendor sends a duplicate invoice or if a vendor does not properly record a payment.

Duplicate payments can be costly for businesses. They can lead to:

- Wasted money: When you pay a bill twice, you are wasting money that could be used for other purposes.

- Damaged relationships: If a vendor receives a duplicate payment, they may be upset and may not want to do business with you in the future.

- Financial problems: If you make too many duplicate payments, you may have financial problems. This is because you may not have enough money to cover all of your bills.

There are a number of things you can do to avoid duplicate payments:

- Implement a process for approving payments: This will help to ensure that all payments are authorized before they are made.

- Use a payment system that can track payments: This will help you to see which payments have been made and which payments are still outstanding.

- Reconcile your accounts regularly: This will help you to identify any duplicate payments that have been made.

- Work with your vendors to prevent duplicate payments: This can be done by setting up a system for tracking invoices and payments.

By following these tips, you can help to avoid duplicate payments and save your business money.

Here are some additional tips for avoiding duplicate payments:

- Use a centralized system for managing invoices and payments. This will help to ensure that all invoices are processed in a timely manner and that payments are made to the correct vendors.

- Set up alerts for overdue invoices. This will help you to identify invoices that have not been paid and to take action to prevent duplicate payments.

- Train your staff on the proper procedures for processing invoices and payments. This will help to reduce the risk of human error.

- Review your payment procedures on a regular basis. This will help you to identify any areas where improvements can be made to reduce the risk of duplicate payments.

By following these tips, you can help to ensure that your business does not make duplicate payments.

Automate Your Workflow

Workflow automation is the process of using software to automate repetitive tasks. This can save businesses time and money, and it can also improve accuracy and productivity.

There are a number of different ways to automate your workflow. One common approach is to use a workflow management system (WFMS). A WFMS is a software application that helps you to automate your workflow by providing a central repository for storing and managing your workflows.

Another approach to workflow automation is to use a business process management (BPM) system. A BPM system is a more comprehensive solution than a WFMS, as it can also help you to improve your business processes.

No matter which approach you choose, workflow automation can be a valuable tool for businesses of all sizes. By automating your workflow, you can free up your time to focus on more important tasks, and you can also improve the accuracy and productivity of your business.

Here are some of the benefits of automating your workflow:

- Save time: Workflow automation can save you time by automating repetitive tasks. This can free you up to focus on more important tasks, such as developing new products or services or improving customer service.

- Reduce errors: Workflow automation can help to reduce errors by eliminating the need for manual data entry. This can save you money and improve your customer satisfaction.

- Improve accuracy: Workflow automation can help to improve accuracy by ensuring that tasks are completed correctly and on time. This can help you to avoid costly mistakes and improve your compliance with regulations.

- Increase productivity: Workflow automation can help to increase productivity by streamlining your processes and eliminating bottlenecks. This can help you to get more done in less time and improve your bottom line.

If you’re looking for ways to improve your business, workflow automation is a great place to start. By automating your workflow, you can save time, reduce errors, improve accuracy, and increase productivity.

Here are some tips for automating your workflow:

- Identify the tasks that can be automated: The first step is to identify the tasks in your workflow that can be automated. These are typically the tasks that are repetitive, time-consuming, or error-prone.

- Choose the right automation tool: There are a number of different automation tools available, so it’s important to choose the right one for your needs. Consider the size of your business, the complexity of your workflow, and your budget.

- Design your workflow: Once you’ve chosen an automation tool, you need to design your workflow. This involves defining the steps in your workflow and the triggers that will start each step.

- Implement your workflow: Once you’ve designed your workflow, you need to implement it. This involves configuring your automation tool and testing your workflow to make sure it works as expected.

- Monitor your workflow: Once your workflow is implemented, you need to monitor it to make sure it’s working as expected. This involves tracking the performance of your workflow and making adjustments as needed.

By following these tips, you can automate your workflow and improve your business.

Find a solution for your accounts payable needs

There are a number of different solutions available for accounts payable (AP) needs. The best solution for your business will depend on your specific requirements. Some factors to consider include:

- The size of your business: AP solutions are available for businesses of all sizes. However, some solutions are better suited for small businesses, while others are better suited for large businesses.

- The complexity of your AP process: If you have a complex AP process, you will need a solution that can handle the complexity. Some solutions offer a wide range of features, while others are more basic.

- Your budget: AP solutions can range in price from free to hundreds of dollars per month. It is important to choose a solution that fits your budget.

Once you have considered these factors, you can start to compare AP solutions. Here are a few of the most popular solutions:

- Tipalti: Tipalti is a cloud-based AP solution that offers a wide range of features, including automated invoice processing, payment approvals, and supplier management.

- Airbase: Airbase is another cloud-based AP solution that offers a wide range of features, including automated invoice processing, payment approvals, and supplier management.

- Bill.com: Bill.com is a cloud-based AP solution that offers a wide range of features, including automated invoice processing, payment approvals, and supplier management.

- SAP Concur: SAP Concur is a cloud-based AP solution that offers a wide range of features, including automated invoice processing, payment approvals, and supplier management.

- Xero: Xero is a cloud-based accounting solution that offers AP features, including automated invoice processing, payment approvals, and supplier management.

No matter which AP solution you choose, it is important to test it thoroughly before you start using it with your vendors. This will help you ensure that it works properly and that your vendors have a positive experience.

Here are a few tips for testing AP solutions:

- Create a test account: Most AP solutions allow you to create a test account. This is a great way to test the features and functionality of the solution without using your real data.

- Make a test purchase: Once you’ve created a test account, make a test purchase. This will help you verify that the solution works properly and that your vendors can use it to pay for your products or services.

- Get help from customer support: If you have any problems with an AP solution, don’t hesitate to contact customer support. Most AP solutions have excellent customer support that can help you troubleshoot any problems.

By following these tips, you can choose the right AP solution for your business and ensure that your vendors have a positive experience.

Maximize your payment volumes to lower your fees

There are a number of ways to maximize payment volumes to lower fees. Here are a few tips:

- Choose the right payment processor: Different payment processors have different fees, so it’s important to compare them before you choose one. Look for a processor that offers volume discounts.

- Use a payment aggregator: A payment aggregator is a company that acts as a middleman between you and the payment processor. They can help you negotiate lower fees and offer a wider range of payment options.

- Accept multiple payment methods: The more payment methods you accept, the more likely your customers are to be able to pay you. This can help you increase your payment volume and lower your fees.

- Offer discounts for early payments: If you offer discounts for early payments, you can encourage your customers to pay you sooner. This can help you improve your cash flow and lower your fees.

- Set up automatic payments: If you set up automatic payments for your recurring bills, you can ensure that you never miss a payment. This can help you improve your credit score and lower your fees.

By following these tips, you can maximize your payment volumes and lower your fees.

Here are some additional tips for maximizing payment volumes:

- Promote your payment options: Let your customers know about all the payment methods you accept. You can do this on your website, in your marketing materials, and in your customer service interactions.

- Make it easy for customers to pay: The easier it is for your customers to pay you, the more likely they are to do so. Make sure your payment process is clear and concise, and that your payment options are easy to find.

- Be patient: It takes time to build up payment volume. Don’t get discouraged if you don’t see results immediately. Just keep working at it, and you’ll eventually see your payment volumes increase.

Eliminate data entry errors

Data entry errors are a common problem for businesses of all sizes. They can lead to a variety of problems, including:

- Inaccurate financial records: Data entry errors can lead to inaccurate financial records, which can make it difficult to track your finances and make informed business decisions.

- Customer dissatisfaction: Data entry errors can lead to customer dissatisfaction, as they can cause problems with orders, billing, and other important customer-facing processes.

- Regulatory compliance issues: Data entry errors can lead to regulatory compliance issues, as they can make it difficult to keep accurate records and meet regulatory requirements.

There are a number of things you can do to eliminate data entry errors:

- Use a data entry software: A data entry software can help you to automate the data entry process and reduce the risk of errors.

- Train your employees: Make sure your employees are properly trained on the data entry process and the importance of accuracy.

- Implement a quality control process: Implement a quality control process to check for errors in the data entry process.

- Use data validation: Use data validation to check for errors in the data being entered.

- Use a double-entry system: A double-entry system is a system where each transaction is entered twice, once in one ledger and once in another. This can help to catch errors in the data entry process.

By following these tips, you can eliminate data entry errors and improve the accuracy of your business data.

Here are some additional tips for eliminating data entry errors:

- Use a consistent format: Make sure that all data is entered in a consistent format. This will make it easier to identify and correct errors.

- Use clear and concise instructions: Make sure that the instructions for data entry are clear and concise. This will help to reduce errors caused by misunderstandings.

- Use a spell checker: Use a spell checker to check for errors in the data being entered.

- Use a grammar checker: Use a grammar checker to check for errors in the data being entered.

- Use a thesaurus: Use a thesaurus to find the correct words to use in the data being entered.

By following these tips, you can further reduce the risk of data entry errors.

Eliminate paper invoices

Here are some tips for eliminating paper invoices:

- Switch to electronic invoicing: Electronic invoicing is the process of sending and receiving invoices electronically. This can be done through a variety of methods, such as email, fax, or a dedicated invoicing software.

- Use a cloud-based accounting system: A cloud-based accounting system can help you to automate your invoicing process and make it easier to track your invoices.

- Set up automatic reminders: Set up automatic reminders for your customers to pay their invoices. This will help to ensure that you get paid on time.

- Offer discounts for early payments: Offer discounts for early payments to encourage your customers to pay their invoices sooner.

- Be patient: It takes time to transition to a paperless invoicing system. Don’t get discouraged if you don’t see results immediately. Just keep working at it, and you’ll eventually see your paper usage decrease.

Here are some of the benefits of eliminating paper invoices:

- Save time: Eliminating paper invoices can save you time by eliminating the need to print, scan, and file invoices.

- Save money: Eliminating paper invoices can save you money by eliminating the need to purchase paper, ink, and postage.

- Improve efficiency: Eliminating paper invoices can improve the efficiency of your invoicing process by making it easier to track and manage invoices.

- Reduce errors: Eliminating paper invoices can reduce errors by eliminating the need to manually enter invoice data.

- Improve security: Eliminating paper invoices can improve the security of your financial data by reducing the risk of lost or stolen invoices.

- Go green: Eliminating paper invoices can help you to go green by reducing your environmental impact.

By following these tips, you can eliminate paper invoices and improve your business.

Evaluate your relationship with your suppliers

valuating your relationship with your suppliers is an important part of running a successful business. By taking the time to assess your current relationships, you can identify areas where you can improve and strengthen your partnerships.

Here are a few tips for evaluating your relationship with your suppliers:

- Consider your needs: The first step is to take a close look at your business and identify your current and future needs. What products or services do you need from your suppliers? What are your expectations in terms of quality, price, and delivery?

- Assess your suppliers: Once you know what you need, it’s time to assess your current suppliers. How well do they meet your needs? Are they reliable? Do they offer competitive prices?

- Communicate with your suppliers: It’s important to communicate regularly with your suppliers. This will help to build trust and understanding, and it will also give you the opportunity to address any issues that may arise.

- Set goals: Once you have a good understanding of your needs and your suppliers, it’s time to set some goals for your relationships. What do you want to achieve with your suppliers? Do you want to improve quality? Reduce costs? Increase efficiency?

- Measure your progress: It’s important to measure your progress against your goals. This will help you to track your success and identify areas where you can improve.

By following these tips, you can evaluate your relationship with your suppliers and identify areas where you can improve. By taking the time to strengthen your partnerships, you can ensure that you have the resources you need to succeed in business.

Here are some additional tips for evaluating your relationship with your suppliers:

- Be honest and transparent: Be honest with your suppliers about your needs and expectations. This will help them to understand your business and provide you with the best possible service.

- Be willing to compromise: No two businesses are exactly alike, so it’s important to be willing to compromise when working with your suppliers. This will help you to find solutions that work for both parties.

- Be patient: Building strong relationships takes time. Don’t expect to become best friends with your suppliers overnight. Just keep working at it, and you’ll eventually build relationships that are based on trust and mutual respect.

Build a Cash Reserve

A cash reserve is a pool of money that businesses set aside to cover unexpected expenses. It can be used to cover things like unexpected sales declines, equipment repairs, or lawsuits. Having a cash reserve can help businesses stay afloat during difficult times and avoid going into debt.

There are a few things businesses can do to build a cash reserve:

- Set a goal: The first step is to set a goal for how much cash you want to have in your reserve. This will depend on your business’s size and industry.

- Make a budget: Once you know how much cash you want to have in your reserve, you need to make a budget to help you reach your goal. This budget should include all of your expenses, including both fixed and variable costs.

- Automate your savings: One of the best ways to save money is to automate your savings. This means setting up a recurring transfer from your checking account to your savings account.

- Cut back on expenses: If you’re struggling to reach your goal, you may need to cut back on your expenses. This could mean eating out less, canceling unused subscriptions, or finding a cheaper place to live.

- Be patient: Building a cash reserve takes time. Don’t expect to have a large amount of money saved up overnight. Just keep working at it, and you’ll eventually reach your goal.

Here are some of the benefits of having a cash reserve:

- Peace of mind: Knowing that you have a financial cushion in case of an emergency can give you peace of mind.

- Ability to take advantage of opportunities: If you have a cash reserve, you’ll be able to take advantage of opportunities that come your way, such as buying a new piece of equipment or expanding your business.

- Reduced stress: Not having to worry about running out of money can reduce stress and improve your overall well-being.

By following these tips, you can build a cash reserve and protect your business from unexpected financial setbacks.

Avoid AP Fraud

Accounts payable (AP) fraud is a type of financial fraud that occurs when an employee or third party makes unauthorized payments to themselves or others. AP fraud can be costly for businesses, and it can also damage their reputation.

There are a number of things that businesses can do to avoid AP fraud, including:

- Implement strong internal controls: Strong internal controls can help to prevent AP fraud by making it more difficult for employees to commit fraud. These controls should include segregation of duties, proper documentation, and regular audits.

- Train employees on fraud prevention: Employees should be trained on how to identify and report fraud. This training should include information on the different types of fraud, the red flags to look for, and how to report fraud.

- Have a whistleblowing policy: A whistleblowing policy allows employees to report fraud without fear of retaliation. This policy should be clearly communicated to employees, and it should be easy for employees to report fraud.

- Use technology: Technology can help to prevent AP fraud by automating processes and making it more difficult for employees to commit fraud. For example, using a payment processing system that requires two-factor authentication can help to prevent unauthorized payments.

- Be vigilant: Businesses should be vigilant in their efforts to prevent AP fraud. This means regularly reviewing invoices, looking for suspicious activity, and investigating any red flags.

By following these tips, businesses can help to protect themselves from AP fraud.

Here are some of the red flags that businesses should look for to identify AP fraud:

- Payments to unknown vendors: Payments to vendors that the business has never heard of or that do not have a good reputation should be investigated.

- Payments for goods or services that were not ordered: Payments for goods or services that the business did not order should be investigated.

- Payments that are significantly larger or smaller than normal: Payments that are significantly larger or smaller than normal should be investigated.

- Payments that are made to the same vendor multiple times in a short period of time: Payments that are made to the same vendor multiple times in a short period of time should be investigated.

- Payments that are made without proper documentation: Payments that are made without proper documentation, such as an invoice or purchase order, should be investigated.

If a business suspects that AP fraud may be occurring, it should immediately investigate the matter. The investigation should be conducted by a qualified professional, such as an accountant or auditor. If the investigation finds evidence of fraud, the business should take steps to recover the lost funds and to prevent future fraud.

Are you ready to streamline your AP processes?

Yes, I am ready to streamline your AP processes. I can help you to:

- Automate your AP processes: This can help you to save time and reduce errors.

- Improve your cash flow: By automating your AP processes, you can make sure that you are paying your bills on time and avoiding late fees.

- Improve your visibility: By automating your AP processes, you will have better visibility into your spending and be able to make more informed decisions about your finances.

- Reduce your risk: By automating your AP processes, you can reduce the risk of fraud and errors.

I can help you to streamline your AP processes by:

- Analyzing your current processes: I will analyze your current AP processes to identify areas where you can improve.

- Developing a plan: I will develop a plan to streamline your AP processes.

- Implementing the plan: I will help you to implement the plan and make sure that it is successful.

I am confident that I can help you to streamline your AP processes and improve your business.

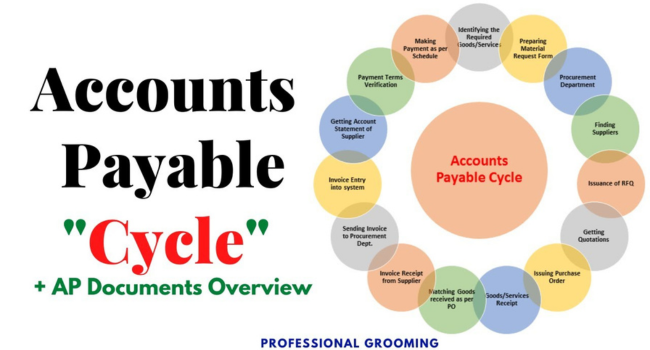

Understanding the Accounts Payable Cycle

The accounts payable cycle (AP cycle) is the process of a company paying its vendors for goods or services that have been received. The AP cycle typically includes the following steps:

- Purchase order: A purchase order is a document that authorizes a company to purchase goods or services from a vendor.

- Receipt: Once the goods or services have been received, the company must verify that they are in good order and that the quantity received matches the quantity ordered.

- Invoice: The vendor will send an invoice to the company, which will list the goods or services that were provided, the quantity, the price, and any applicable taxes.

- Approval: The invoice must be approved by an authorized person before it can be paid.

- Payment: The company will then make payment to the vendor, typically by check or electronic funds transfer.

The AP cycle can vary in length depending on the size and complexity of the company. However, it is important for companies to have a well-defined AP cycle in place in order to ensure that they are paying their vendors on time and avoiding late fees.

There are a number of benefits to having a well-defined AP cycle in place, including:

- Improved cash flow: By paying vendors on time, companies can improve their cash flow and avoid late fees.

- Reduced risk of fraud: A well-defined AP cycle can help to reduce the risk of fraud by ensuring that only authorized personnel are able to approve payments.

- Improved visibility: A well-defined AP cycle can help companies to improve their visibility into their spending and make more informed decisions about their finances.

There are a number of things that companies can do to improve their AP cycle, including:

- Automating the AP process: There are a number of software solutions available that can help companies to automate their AP process. This can help to save time and reduce errors.

- Implementing a strong internal control system: A strong internal control system can help to reduce the risk of fraud and errors.

- Providing training to employees: Employees should be trained on the AP process and the importance of following procedures.

- Monitoring the AP process: Companies should regularly monitor their AP process to identify areas where they can improve.

By taking these steps, companies can improve their AP cycle and achieve a number of benefits, including improved cash flow, reduced risk of fraud, and improved visibility into their spending.

Budget Appropriately

Budgeting is the process of planning how you will spend your money. It involves setting financial goals, tracking your income and expenses, and making adjustments as needed.

There are many different ways to budget, but the most important thing is to find a method that works for you and stick to it. Here are a few tips for budgeting appropriately:

- Start by tracking your income and expenses. This will give you a good understanding of where your money is going. You can use a budgeting app or spreadsheet to track your spending.

- Set financial goals. What do you want to achieve with your money? Do you want to save for a down payment on a house, pay off debt, or save for retirement? Once you know what you want to achieve, you can start to create a budget that will help you reach your goals.

- Be realistic. When you’re creating your budget, it’s important to be realistic about your income and expenses. Don’t try to cut too much too soon, or you’ll be more likely to give up on your budget altogether.

- Be flexible. Things happen, and sometimes you’ll need to adjust your budget. That’s okay! Just make sure to adjust your budget as soon as possible so that you don’t get behind.

- Make it a habit. The key to budgeting successfully is to make it a habit. Once you get into the habit of tracking your income and expenses, and making adjustments as needed, budgeting will become second nature.

Here are some additional tips for budgeting appropriately:

- Set aside money for savings. Even if it’s just a small amount, it’s important to start saving money as soon as possible.

- Pay off debt as quickly as possible. The interest you pay on debt can add up quickly, so it’s in your best interest to pay off debt as soon as possible.

- Live below your means. This is one of the most important tips for budgeting appropriately. If you live below your means, you’ll have more money to save and invest.

- Don’t be afraid to ask for help. If you’re struggling to budget, there are plenty of resources available to help you. You can talk to a financial advisor, or you can find budgeting tips online or in books.

Budgeting can seem daunting at first, but it’s a skill that everyone should learn. By following these tips, you can learn to budget appropriately and achieve your financial goals.

Set up reminders for payments

There are many ways to set up reminders for payments. Here are a few options:

- Use a budgeting app. Many budgeting apps have a feature that allows you to set up reminders for upcoming payments. This can be a great way to stay on top of your bills and avoid late fees.

- Use a calendar app. You can also use a calendar app to set up reminders for upcoming payments. This is a good option if you don’t want to use a budgeting app.

- Set up automatic payments. If you have the option, you can set up automatic payments for your bills. This will ensure that your bills are paid on time, and you won’t have to worry about forgetting to make a payment.

- Set up text or email reminders. You can also set up text or email reminders for upcoming payments. This is a good option if you want to be notified as soon as a payment is due.

No matter which method you choose, it’s important to set up reminders for upcoming payments so that you can avoid late fees and keep your finances in order.

Here are some additional tips for setting up reminders for payments:

- Set reminders early. Don’t wait until the day before a payment is due to set a reminder. Give yourself plenty of time to make the payment so that you don’t forget.

- Make sure the reminders are clear. The reminder should include the name of the bill, the amount due, and the due date.

- Test the reminders. Once you’ve set up the reminders, test them to make sure they’re working properly.

- Review the reminders regularly. As your financial situation changes, you may need to adjust your reminders. Make sure to review them regularly to make sure they’re still accurate.

By following these tips, you can set up reminders for payments and avoid late fees.

Keep an eye on your payment notifications and reports

It is important to keep an eye on your payment notifications and reports for a number of reasons. First, it can help you to avoid late fees. If you don’t pay your bills on time, you may be charged a late fee. These fees can add up quickly, so it’s important to pay your bills on time.

Second, keeping an eye on your payment notifications and reports can help you to identify any problems with your payments. For example, if you see that a payment has been declined, you can take steps to correct the problem. This can help to prevent your account from being sent to collections.

Third, keeping an eye on your payment notifications and reports can help you to stay on top of your finances. By tracking your spending, you can make sure that you’re not overspending. This can help you to avoid debt and save money.

Here are a few tips for keeping an eye on your payment notifications and reports:

- Set up alerts. Many companies offer the option to set up alerts for upcoming payments. This can be a great way to make sure that you don’t forget about a payment.

- Check your accounts regularly. Even if you have set up alerts, it’s still a good idea to check your accounts regularly. This will help you to catch any problems early on.

- Review your reports. Most companies will send you monthly or quarterly reports that show your spending. Review these reports carefully to make sure that you understand where your money is going.

By following these tips, you can keep an eye on your payment notifications and reports and stay on top of your finances.

Look for Discounts

There are many ways to look for discounts. Here are a few options:

- Use a discount website. There are many websites that list discounts on a variety of products and services. These websites can be a great way to find deals on the things you want and need.

- Sign up for email lists. Many companies offer discounts to their email subscribers. By signing up for email lists, you can be notified of new discounts as soon as they become available.

- Look for coupons. Coupons can be found in newspapers, magazines, and online. Coupons can save you a significant amount of money on your purchases.

- Shop around. Don’t just buy the first thing you see. Shop around to compare prices and find the best deal.

- Negotiate. In some cases, you may be able to negotiate a discount on the price of a product or service. This is especially true if you’re buying in bulk or if you’re a repeat customer.

By following these tips, you can save money on your purchases by looking for discounts.

Here are some additional tips for looking for discounts:

- Be patient. It may take some time to find the best deals. Don’t get discouraged if you don’t find a discount right away.

- Be flexible. Be willing to change your plans if you find a better deal. For example, if you’re planning to buy a new car, be willing to look at different models and brands if you find a better deal on one.

- Be organized. Keep track of the discounts you find. This will make it easier to compare prices and find the best deal.

By following these tips, you can save money on your purchases by looking for discounts.

Keep contact information updated

Here are some tips on how to keep your contact information updated:

- Review your contact information regularly. This could be once a month, once a quarter, or even once a year. Make sure that all of your contact information is up-to-date, including your name, address, phone number, email address, and social media handles.

- Use a contact management system. A contact management system can help you to keep track of all of your contacts in one place. There are many different contact management systems available, so find one that works for you.

- Ask for updates from your contacts. When you talk to your contacts, ask them if their contact information has changed. This is a good way to make sure that you have the most up-to-date information.

- Update your contact information when you move or change jobs. When you move or change jobs, make sure to update your contact information with your new address and phone number. This will help to ensure that you continue to receive important information from your contacts.

- Be careful about sharing your contact information. Only share your contact information with people you trust. If you’re not sure whether or not you should share your contact information with someone, it’s best to err on the side of caution and not share it.

By following these tips, you can keep your contact information updated and ensure that you’re always able to reach the people you need to.

Reconcile accounts on a regular basis

Reconciling your accounts is the process of comparing your bank statements to your accounting records to make sure they match. This is an important step in maintaining your financial records and ensuring that your accounts are accurate.

Here are some tips on how to reconcile your accounts on a regular basis:

- Choose a frequency that works for you. Some people choose to reconcile their accounts once a month, while others prefer to do it more often. Choose a frequency that you can stick to and that will give you peace of mind.

- Gather your statements and records. You will need your bank statements and your accounting records for the period you are reconciling. If you use a budgeting app, you may also want to gather your transaction history from that app.

- Start by comparing the balances. The first step is to compare the ending balance on your bank statement to the ending balance in your accounting records. If the two balances are not the same, you will need to find the discrepancy.

- Identify and correct any discrepancies. Once you have identified the discrepancy, you will need to figure out what caused it. Once you know the cause, you can take steps to correct it.

- Review your records. Once you have corrected any discrepancies, you should review your records to make sure they are accurate. This will help to ensure that you catch any errors early on.

- Repeat the process regularly. Once you have reconciled your accounts, you should repeat the process regularly. This will help to ensure that your accounts are always accurate.

By following these tips, you can reconcile your accounts on a regular basis and ensure that your financial records are accurate.

Here are some additional tips for reconciling your accounts:

- Use a spreadsheet or accounting software. Using a spreadsheet or accounting software can make the reconciliation process easier. There are many different software programs available, so find one that works for you.

- Be organized. Make sure that you keep your bank statements and accounting records in a safe place. This will make it easier to find them when you need to reconcile your accounts.

- Be patient. Reconciling your accounts can take some time, especially if you have a lot of transactions. Don’t get discouraged if it takes you a few hours to complete the process.

By following these tips, you can reconcile your accounts on a regular basis and ensure that your financial records are accurate.

Keep track of disputes and resolutions

Here are some tips on how to keep track of disputes and resolutions:

- Document everything. This includes any correspondence, emails, phone calls, or meetings related to the dispute.

- Keep a timeline of events. This will help you to remember what happened and when.

- Identify the key players. This includes both the people involved in the dispute and any third parties who may be involved in the resolution process.

- Keep track of the progress. This includes any agreements that have been reached, any deadlines that have been set, and any outstanding issues.

- Be prepared to compromise. In most cases, a dispute will not be resolved without some compromise. Be prepared to give a little in order to get a little.

- Be patient. It may take some time to resolve a dispute. Be patient and don’t give up.

By following these tips, you can keep track of disputes and resolutions and increase your chances of a successful outcome.

Here are some additional tips for keeping track of disputes and resolutions:

- Use a dispute resolution software. There are a number of software programs available that can help you to keep track of disputes and resolutions. These programs can help you to organize your documents, track deadlines, and communicate with the other parties involved in the dispute.

- Hire a mediator. A mediator is a neutral third party who can help you to resolve a dispute. Mediators can help you to communicate effectively, identify common ground, and reach a mutually agreeable solution.

- Take your dispute to court. If you are unable to resolve a dispute through mediation, you may need to take your dispute to court. However, this should be a last resort, as it can be time-consuming and expensive.

By following these tips, you can increase your chances of resolving a dispute successfully.

Reduce costs by supporting ACH or direct debit

Sure, here are some ways to reduce costs by supporting ACH or direct debit:

- Reduce transaction fees: ACH and direct debit transactions typically have lower transaction fees than credit or debit card transactions. This can save you money on each transaction, especially if you have a high volume of transactions.

- Reduce fraud: ACH and direct debit transactions are less susceptible to fraud than credit or debit card transactions. This is because the funds are withdrawn directly from the customer’s bank account, making it more difficult for fraudsters to steal money.

- Improve customer satisfaction: Customers often prefer to use ACH or direct debit because it is a convenient and secure way to pay. Offering these payment methods can help you to improve customer satisfaction and loyalty.

Here are some additional tips for reducing costs by supporting ACH or direct debit:

- Educate your customers about ACH and direct debit: Many customers are not familiar with these payment methods. Educating your customers about the benefits of ACH and direct debit can help you to increase adoption.

- Make it easy for customers to set up ACH or direct debit: The easier it is for customers to set up ACH or direct debit, the more likely they are to use these payment methods. Make sure your website or app is easy to use and that you provide clear instructions on how to set up ACH or direct debit.

- Offer incentives for using ACH or direct debit: You can offer incentives to customers who use ACH or direct debit, such as discounts or rewards. This can help to encourage customers to use these payment methods.

By following these tips, you can reduce costs and improve customer satisfaction by supporting ACH or direct debit.

Conclusion

In conclusion, there are a number of ways to reduce costs by supporting ACH or direct debit. By following the tips above, you can save money on transaction fees, reduce fraud, and improve customer satisfaction. Supporting ACH or direct debit can be a great way to improve your bottom line and provide your customers with a more convenient and secure way to pay.

Here are some additional benefits of supporting ACH or direct debit:

- Increased efficiency: ACH and direct debit transactions can be processed more quickly and efficiently than credit or debit card transactions. This can save you time and money, and it can also improve customer satisfaction.

- Improved cash flow: ACH and direct debit transactions can help you to improve your cash flow by providing you with a more predictable stream of income. This can help you to better manage your finances and avoid overdraft fees.

- Reduced risk: ACH and direct debit transactions are less risky than credit or debit card transactions. This is because the funds are withdrawn directly from the customer’s bank account, making it more difficult for fraudsters to steal money.

If you are looking for ways to reduce costs, improve efficiency, and improve cash flow, supporting ACH or direct debit is a great option.